Working Capital in easy words and a Cash Flow Tree to print out

What is working capital? If you check Google or ask a finance guru, you will most probably receive an answer like the following: Working Capital is the difference between a company’s current assets like cash, accounts receivable, inventories of raw materials and finished goods and its current liabilities, such as accounts payable and debts. Ah yes….and what is it in easy words? Working Capital is all about liquidity, is all about the cash you can “work with” to pay your employees and your bills. So therefore, it means everything to a start-up when the runway is getting shorter and shorter.

For a young company it is not that easy to go to a bank and ask for a debt, would say rather impossible. You must know when your last cent is used and when. This you should know at least 6 months before your bank account is empty. What can you do, to keep the cash as long as possible in your pockets? 10 Tipps for you below and at the end of this blog article, you find my Cash Flow Tree as a download. Print it and put it as a poster in front of the coffee machine that everybody can see her/his responsibilities and the impact they have on the cash of the company.

1. Walk through your Sales Forecast every week together with your sales guys and adjust it accordingly. Have a look at your leads and your pipeline and know exactly what is coming in the next weeks, months, quarters – ask questions questions questions. Make it clear to the sales team that a correct and reliable forecast is essential for the company to survive. In your Cash Forecast, consider the payment terms as well. A sent invoice does not mean immediately to have cash on your account. If you have sales planned for the next weeks, but your customers have 90 days payment terms – consider this in your Cash Forecast!

2. Customer Payment Monitoring: Set up an Account Receivable Process and walk through your open item list at least once a month. This list you will get out of your accounting system – no matter which one you are using – or ask your tax consultant to send it to you regularly if you don’t have your own system. This list consists of all your unpaid invoices you sent to the customers. Are your customers paying in time?

Customers are NOT paying on time – Actions:

- Sales guys should not be responsible for chasing the money, as they should be the “good” guys and sell your products. The accountant needs to get in contact to the salesperson and agree together on next steps.

- Do you have a Dunning Process – are dunning letters send regularly?

Check WHY customers are paying late:

- Customer has a long approval procedure, so maybe we have to invoice earlier.

- Invoices are not sent electronically (email, fax, etc.) we are losing time with paperwork and mailing.

- Invoices are too complicated – the approver on customer site needs a lot of time to understand the invoice and find the PO (Purchase Order Number) for the invoice. All invoices must have the Due Date and the Bank account information on the invoice (clearly visible).

3. Are your payment terms for your customers in line with the ones you have with your suppliers? If customers paying after 90 days and you pay your suppliers after 10 days – you have a serious problem. Make sure the sales team is aligning with you before they finalize the negotiations on the contracts with the customers and are finding a good balance between reasonable sales prices and payment terms. As an example, for subscriptions a lot of companies offer a lower price if customers pay yearly, instead of monthly.

4. Accounts Payable: Don’t pay your suppliers too early. Check the Due Dates at the invoices, don’t pay before the due date, maybe take 2 days more. Make sure all invoices are approved before paying them – sometimes you have scams, or invoices should not be paid as the service was not sufficient, etc. For more info check out the approval process in my toolbox in chapter 3. Don’t pay suppliers twice – I heard this happened in early-stage start-ups 😉

5. Accounts Payable Process – know very well which payments are coming and when to avoid any bad surprises. Walk through the open account payables list regularly. As the open item list for the customers, your tax consultant can easily provide you with those lists. In this list you can see what payments are due within the next weeks (If the subledger is maintained in the booking system). Don’t forget to think about VAT payments to the tax offices, salary & wages taxes or fees that are coming and not part of the open item list.

6. Watch your Budget: Don’t lose it out of your eyes – watch it closely and ask within the teams if they plan any other expenses than budgeted. Do monthly check-ins with the individual budget owner.

7. Maintain a Liquidity/Cash Planning File, if you don’t have the budget for automation tools. If you are a finance person you know this, but just a reminder, the Profit and Loss statement is not what is leaving your bank account. The same with your budget file. An invoice can be booked in a month, but the money is leaving your account later or earlier. The same with the sales as mentioned above. Therefore, I would always recommend tracking it in a separate file and combine all the mentioned points in this file for your cash planning. In my start finance – toolbox I explain how you can use an excel to combine all the mentioned topics above. Furthermore, you will learn how to reconcile transactions and turnovers from different bank accounts and transfer them to your own cash planning. All the above without an extra tool for the ones with limited budget.

8. Inventory – Of course, all businesses are different, some have goods in their warehouses, some don’t. I skip a detailed inventory topic here as this is clear, the more goods you have in your warehouse the less you have cash in your pocket.

9. Spend the money you have very smart:

- Find your costs monsters – often hidden in old contracts nobody is aware of like licenses, phone costs, travel, etc. It’s going to be a separate topic in the blog and has its own chapter in my ,toolbox (with templates on how to track and find them).

- Smart investment approval process: If teams are asking for money to buy tools, licenses, machines etc., it is up to you to ask the right questions: Is it really needed, are there any alternatives available and calculate an easy understandable business case – people tend to spend money easier if it is not their own. Don’t be the bad guy, just help them taking the right decisions. Find more information in chapter 10 of the toolbox.

- Am I making money with my customers, do I know what a customer’s costs me?

- …so on and so force. I am covering more topics in the toolbox.

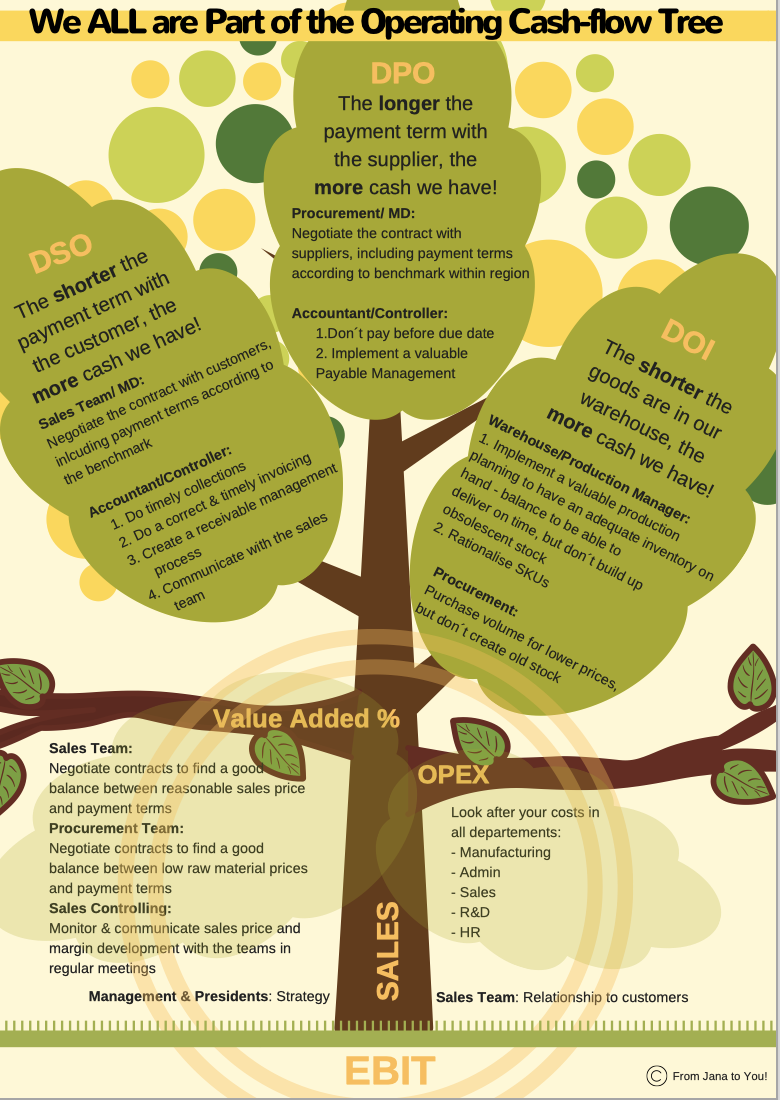

10. Cash Flow Tree. I worked on a little Cashflow Tree that you can print and put at a wall in front of your office coffee machine. Make Working Capital a topic for all departments to see which impact each and everybody have with their daily actions on the cash of the company. Be transparent and share regular updates. You could put names behind every topic (with post-its for instance) to make it even more specific.

Download it here for free:

I am aware that all those topics are only touched on here, and I could fill a book with recommendations. This little guide will hopefully help you to get some first ideas on how to get a better feeling of your working capital. Check out my ,start finance toolbox or get in touch with me and be the master of your runway!

Any feedback or anything to add, please contact me at jana@startfinance-now.com.